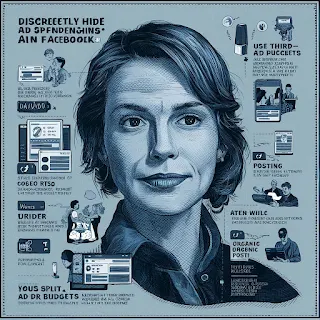

1. Budget Management

Use Different Campaigns:

- Split your ad budget across different campaigns and ad sets. This can help in tracking the performance of each campaign separately and managing budgets more effectively.

Daily vs. Lifetime Budgets:

- Use daily budgets for consistent daily spending or lifetime budgets for flexibility within a campaign's total duration.

2. Advanced Reporting

Custom Reports:

- Create custom reports in Facebook Ads Manager to focus on specific metrics or time frames. This can help in isolating certain expenditures and understanding their impact better.

Use Attribution Tools:

- Leverage Facebook’s attribution tools to better understand the customer journey and allocate ad spend more accurately.

3. Ad Spend Allocation

Allocate Budgets Across Accounts:

- Use multiple ad accounts to run different campaigns. This can help in separating ad spends for different projects, products, or departments.

Cross-Platform Advertising:

- Spread your advertising budget across different platforms (Google Ads, Instagram, LinkedIn) to diversify your ad spend and optimize overall budget management.

4. Tracking and Analysis

UTM Parameters:

- Use UTM parameters in your ad URLs to track the performance of your ads through Google Analytics or other tracking tools.

Regular Audits:

- Conduct regular audits of your ad spend to ensure that funds are being used efficiently and effectively.

5. Billing Management

Set Billing Thresholds:

- Use Facebook’s billing thresholds to control how often you are billed, which can help in managing cash flow and expenditure tracking.

Detailed Invoicing:

- Request detailed invoices that break down your ad spend by campaign, ad set, and ad to better understand and manage your expenses.

6. Collaboration with Finance Team

Regular Meetings:

- Have regular meetings with your finance team to discuss ad spend and ensure that it aligns with your overall budget and financial strategy.

Financial Reporting Tools:

- Use financial reporting tools and software to integrate ad spend data and provide a comprehensive view of your expenses.

7. Optimize Ad Performance

A/B Testing:

- Continuously run A/B tests to determine which ads perform best. This can help in allocating budget more effectively and reducing wasted spend.

Audience Segmentation:

- Segment your audience to target specific groups more effectively, reducing ad spend wastage.

8. Utilize Facebook Tools

Facebook Pixel:

- Use the Facebook Pixel to track conversions and optimize your ad spend based on actual performance.

Ad Scheduling:

- Schedule ads to run at times when your audience is most active to get the most out of your ad spend.

Ethical Considerations

It’s important to maintain ethical standards in advertising and financial reporting. Attempting to hide or misrepresent ad spending can lead to legal issues and damage your brand’s reputation. Always aim for transparency and honesty in all business operations.

By focusing on effective budget management, advanced reporting, and performance optimization, you can manage your Facebook ad spend more efficiently without resorting to unethical practices.

Comments

Post a Comment